Short Term

Rental Financing

Expand Your Portfolio &

Build Your Empire

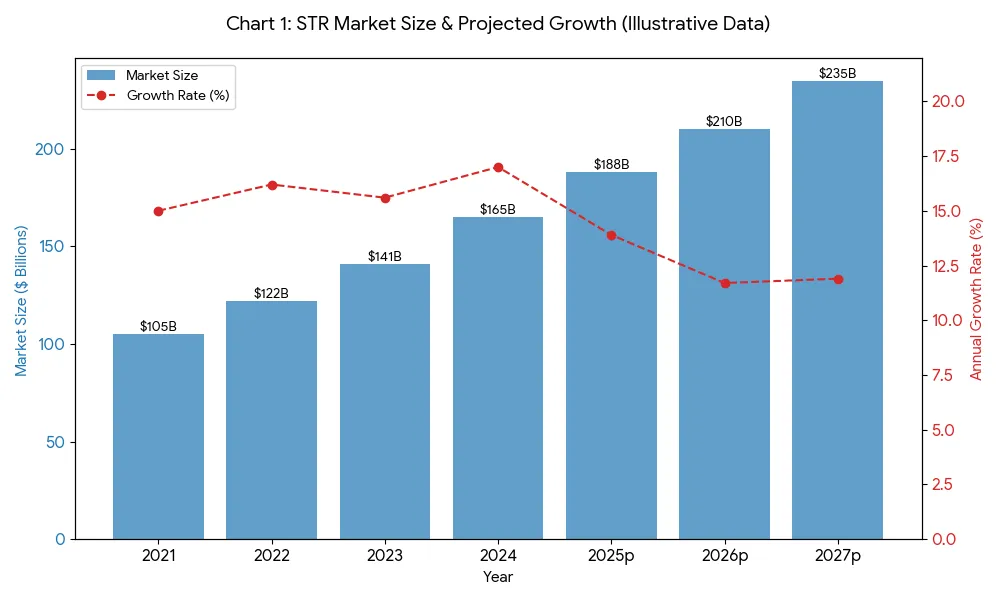

Demand for Growth Consistently Outpacing Supply

This signals a healthy market where new properties are being absorbed by an even faster-growing customer base, which helps maintain strong occupancy and pricing power.

Airbnb & Vrbo Mortgage Loans

Your situation is one-of-a-kind—

I’ll help you find the perfect funding for your next deal

Single-Family

Condominiums

Townhomes

Multi-Unit Properties

Vacation Homes

Cabins or Cottages

Luxury Properties

STR Investment Calculator

Purchase & Loan

Income & Expenses

Projections & Sale

Why Choose NEXA Mortgage?

There Are Many Lenders, So Why Choose Us?

Broker lenders have lower overhead, provide better rates, reduced closing costs, and offer personalized lending solutions designed around your goals.

200+ Lenders

including DSCR, STR, and Fix & Flip

Available in the following states

AL, AK, AR, CO, CT, DE, FL, HI, IL, IN, IA, KS, KY, ME, MI, MS, MO, MT, NE, NH, NM, NC, OK, OH, PA, SC, RI, TX, TN, VA, WA, WV, WI, WY, District of Columbia, Puerto Rico, US Virgin Islands

What documents do I need?

For DSCR Loans Only

Entity documents

Schedule of REO

Property documents

2 months Bank Statements - showing downpayment and any reserves

Copy of lease & rent rolls (if vacant, use market rents)

Personal & Business Financial Statements

Including YTD Profit & Loss Statement and Balance Sheet

Business Bank Statements

2 most recent consecutive bank statements for all accounts. If you are doing a Bank Statement Loan, then we need most recent 12 or 24 months of Business Bank Statements and Personal Bank Statements.

Personal & Business Tax Returns

2 to 3 years for each guarantor plus 2 to 3 years for the entity, all schedules

Entity Documents

Articles of Incorporation/Organization

Operating or Partnership Agreement

EIN letter from IRS

Certificate of Good Standing

Schedule of Real Estate Owned

All real estate owned by the entity and guarantors

Property Documents

Purchase Contract

Occupancy Rate

Rental Income Statements

Operating Statements (last 24 months)

Environmental Report

Property Condition Report (if required)

Survey

Short Term Rental Permits (if required)

Property Management Agreement

Insurance Documentation (for short term activities)

SBA Loans Need the Following

Detailed summary of the loan request

3 years business tax returns

Year-to-Date P&L and balance sheet

3 years personal tax returns

Borrower information/Resume

Personal financial statement

Business debt schedule

Credit authorization completed & signed for soft pull

Last 2 months of business bank statements

Address of the property

Is the business owned 100% by a U.S. Citizen(s) or ITIN holders?

Contact Us

Kelly Fest

NMLS # 202374

972-854-3270

NEXA Mortgage LLC

https://nexamortgage.com

NMLS #1660690

AZMB #0944059

Corporate Office

5559 S Sossaman Rd

Bldg # 1 Ste # 101

Mesa, AZ 85212