Downpayment Essentials

"The Secret Sauce"

Solutions to make your downpayment more attainable

Myth: You need to put 20% down to buy a home.

When you put less than 20% down, you are required to pay PMI (also known as Mortgage Insurance) each month with your payment. This insures the lender in case you default on the loan. Most loan programs let you drop the PMI once you have paid the loan down to a certain point.

Downpayment Assistance Options

Bridging the Gap to Homeownership

1. Lender Provided Options

2. State Programs

3. Local Housing Authorities

***Lender provided options are faster than the other two

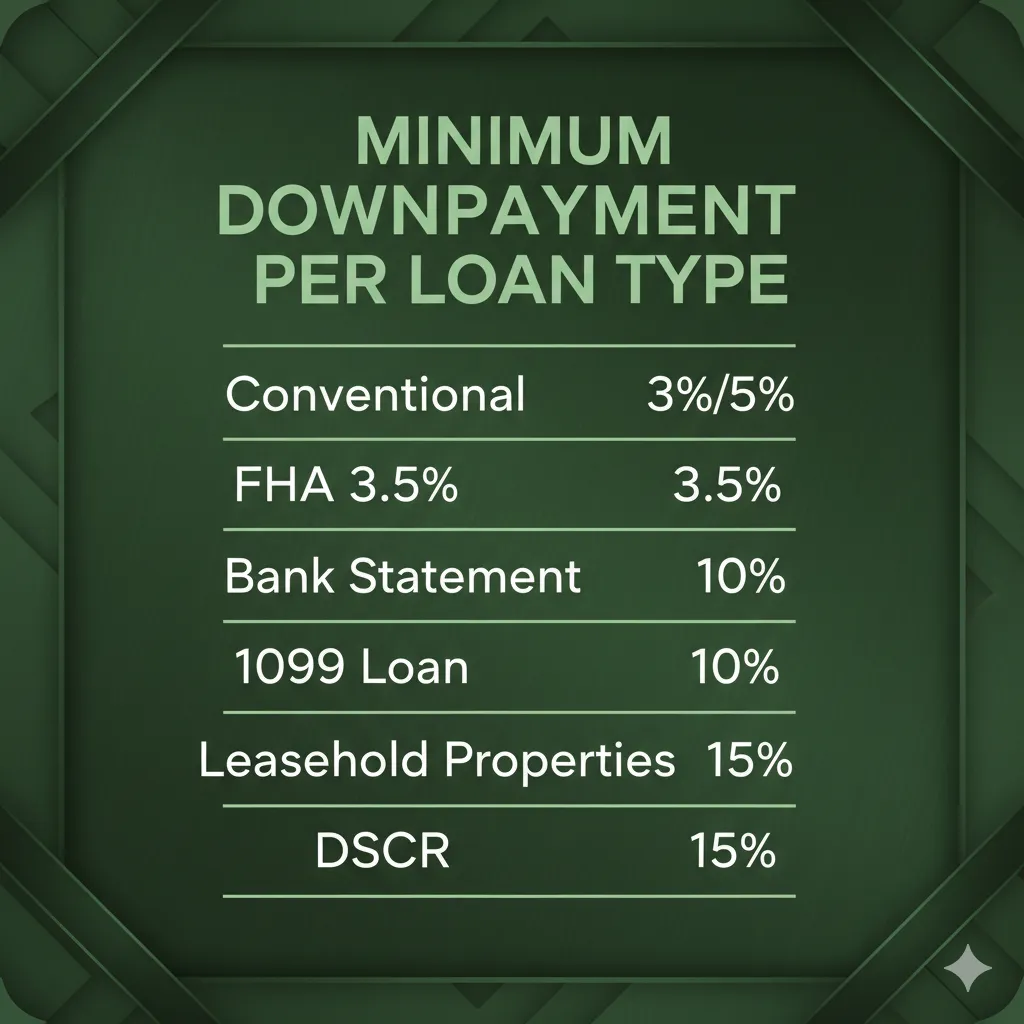

Minimum Down Payment

Other Downpayment Sources

Gift from Family

Gift from Employer

401k/403b/Retirement

Liquidated Investments

***All Funds Must Be Sourced***

Absolutely NO Mattress Money!

Rent vs. Buy

Compare the long-term wealth impact.

Current Rental Situation

Purchase Scenario

Market & Ownership Assumptions

The Verdict

Over 7 years, renting is a 100% sunk cost. Buying builds equity that you keep.

Financial Position after 7 Years

Why Choose NEXA Mortgage?

There Are Many Lenders, So Why Choose Us?

Broker lenders have lower overhead, provide better rates, reduced closing costs, and personalized lending solutions designed around your goals.

Hundreds of Loan Programs

Including Downpayment Assistance

Upload All Documents Online

What documents do I need?

W2's or 1099's

- 2 most recent consecutive years worth of W2's

- If self-employed, we also need your 1040 tax returns with all schedules for most recent two consecutive years.

- If 1099 employee, 2 years of 1099's for a 1099 Loan (10% expense factor & 6 months reserves required)

2 months Bank Statements (no NSF's)

2 most recent consecutive bank statements for all accounts. If you are doing a Bank Statement Loan, then we need most recent 12 months of Business Bank Statements and Personal Bank Statements.

30 Days Paystubs

One months worth of paystubs, plus your end of year December paystubs for most recent consecutive 2 years showing your YTD earnings, bonuses, overtime, etc.

Driver's License

Must be for the address where you currently live and cannot be expired

Insurance Agent's Name & Number

We need this as soon as possible so that we can have an accurate Homeowners insurance amount for your disclosures and paperwork.

12 Months Rental or Mortgage History

If you are renting, we either need cancelled checks for 12 months or written verification from your landlord. If you currently have a mortgage, we can verify this information with your current mortgage company.

Homeowners Association (HOA) Info (if applicable)

If there is an HOA connected to the subject property, we must have written verification of amount and payment history.

Contact Us

Kelly Fest

NMLS # 202374

972-854-3270

NEXA Mortgage LLC

https://nexamortgage.com

NMLS #1660690

AZMB #0944059

Corporate Office

5559 S Sossaman Rd

Bldg # 1 Ste # 101

Mesa, AZ 85212